Global Logistics Companies Pivot Narratives to Navigate Trade Volatility

Global logistics leaders are redefining their role from carriers to strategic partners, using AI, policy engagement, and storytelling to ensure resilient supply chains and maintain trade continuity amid geopolitical and economic disruptions.

In a continuing series on narrative strategy and scaling across different industries, this week we look at how companies in global trade, supply and logistics are adapting to the shifting rhetoric around globalisation and voter demands for economic policy that puts nations before multinational companies.

Indeed few global industries have undergone as much turmoil as the market for global trade in goods and services.

In an era where geopolitical fault lines dictate freight routes as much as fuel costs do, global logistics companies are confronting an existential question: How do you keep goods, and trust, moving when the world itself doesn’t stand still?

From Red Sea shipping corridors compromised by conflict to tariff policies that shift with election cycles, the business of global trade has transformed from a predictable exercise in optimisation into a daily exercise in crisis navigation.

World Economic Forum: Themes driving trade challenges & opportunities

But the most sophisticated players that facilitate the movement of goods aren’t just adapting their operations - they’re rapidly rewriting their role in the global economy, positioning themselves as the architects of stability in an increasingly unstable world.

A bit of background.

While US President, Donald Trump’s focus on tariffs for exporters to the US has put this centre stage in 2025 it’s not just the ‘Trump effect’ that’s driving it.

Since the start of the decade the Covid pandemic, geopolitical and macroeconomic uncertainty put the value of globalisation into the spotlight more clearly than any time since the phrase was first coined in the early 1980s.

It’s no small debate.

The total value of the trade in goods and services worldwide in 2022 was $24.9 trillion - roughly 60% of global output.

Global trade seemed unshakeable until 2020. The value of global trade has grown every decade since the 1950s. It’s worth 12 times more in 2025 than it was 40 years ago.

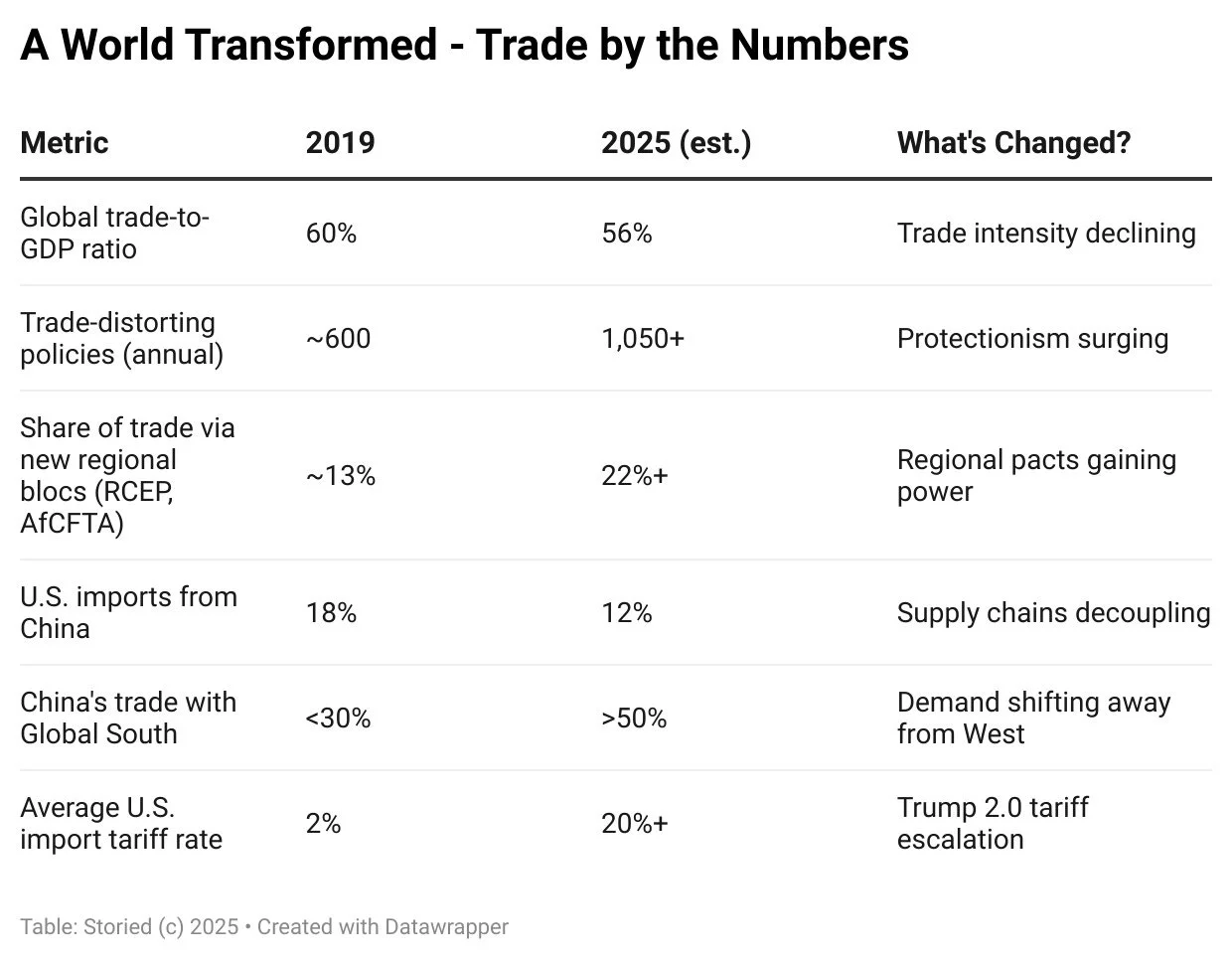

The pandemic, and the economic and political maelstrom in the years following changed that, provoking a wholesale realignment that has continued through the middle of this decade: global trade dropped 15% during the pandemic, while the re-election of Donald Trump has seen US imports from China drop by a third and the number of what the World Trade Organisation (the global arbiter of the the rules governing global trade) calls “trade distorting policies” has nearly doubled (see box - A World Transformed, below).

It already a truism to say that the old days of uncertainty have been washed away, replaced in their wake by unrelenting volatility.

And for companies at the forefront of global trade - those in supply chain, logistics, freight and shipping - and countries at the axis of fast-growing regions like the Gulf, emerging Asia, and Africa - are finding new areas of opportunity as fast as they can re-frame their narratives, and their strategies, to the new climate.

The Narrative Pivot: From Carriers to Custodians

The transformation is as much rhetorical as operational.

Where logistics giants once competed on speed and cost, they now compete on something more fundamental: the promise of continuity and reliability.

Denmark-headquartered Maersk, the world’s largest container shipping company, no longer describes itself as merely moving containers. It frames its mission as “building resilient supply chains” - a shift that repositions the company from service provider to strategic partner.

Through white papers co-authored with think-tanks and blockchain-based visibility platforms like TradeLens, Maersk has inserted itself into policy dialogues about trade security, earning government partnerships and a 20% boost in multinational client retention during periods of peak instability.

SEKO Logistics, a global logistics company based in the USA, has embraced what it calls “logistics agility as a geopolitical shield,” publishing case studies showing how the firm rerouted port-dependent clients via air and rail during sanctions across Asia-Pacific.

The messaging is deliberate: In a world where traditional routes can close overnight, flexibility becomes the product.

In another example UPS invested heavily in digital twin technology - creating virtual replicas of its entire distribution network to simulate crisis scenarios from trade wars to wildfire disruptions.

UPS promotes using documentary-style storytelling campaigns, in the process positioning itself as a “data-driven trade infrastructure backbone instead of its traditional role as a “brown box delivery service.”

During wildfire disruptions in the summer this year in Southern Europe, UPS maintained a 99% on-time delivery rate for pharmaceutical and retail clients - a statistic the firm uses as an operational proof point and brand narrative (see case studies below).

In growth-regions too large firms are finding the words to position themselves and what they do as a global ‘good’. DP World of the UAE - which operates logistics and port infrastructure across more then 75 countries - focuses on its role as an enabler of a world where “trade works for everyone”.

Three Narrative Shifts Driving Logistics Leadership

1. From Chaos to Coordination

Old message: “We ship faster.”

New message: “We stabilise trade in unstable times.”

2. From Carrier to Consultant

Old message: “We move things.”

New message: “We advise your movement strategy.”

3. From Operational to Political Actor

Old message: “We provide logistics.”

New message: “We defend open trade.”

Case Studies: Strategy Meets Storytelling

📦 Box Inc.: From Storage to Strategic Infrastructure

Challenge: Rising AWS costs threatened Box’s ability to serve 120,000+ enterprise customers while maintaining innovation velocity.

Action: Adopted the AWS Well-Architected Framework and deployed Edge Delta telemetry pipelines to streamline data routing and reduce infrastructure complexity.

Narrative Shift: From “secure cloud storage” to “intelligent content backbone for digital transformation” Box repositioned itself as essential infrastructure, not just a vendor.

Outcome: Massive cost savings reinvested into AI integration; perception shift from tool to platform partner.

🚚 Maersk: The Supply Chain Diplomat

Challenge: Suez Canal disruptions and Red Sea attacks threatened reliability across core trade corridors.

Action: Expanded integrated logistics solutions, launched blockchain-based TradeLens platform, and co-authored policy white papers with think tanks on trade security.

Narrative Shift: From “we move containers” to “we build resilient supply chains”-inviting customers to be part of a shared mission.

Outcome: 20% increase in multinational client retention, improved Net Promoter Scores, new government advisory partnerships.

📈 Flexport: Fintech Meets Freight

Challenge: U.S.-China tariff tensions created regulatory chaos for e-commerce brands scaling internationally.

Action: Applies fintech principles to freight forwarding - real-time dashboards, predictive analytics, and a “Trade Advisory” service that helped clients strategically reroute production and shipping.

Narrative Shift: From “digital freight forwarder” to “growth enabler for global brands” - humanising the platform through expert guidance.

Outcome: Helped hundreds of SMBs mitigate tariff impact; grew platform usage 3x during peak 2023–2024 volatility.

🌍 DP World: Ports as Platforms for Inclusion

Challenge: Geopolitical instability, container bottlenecks, and fragmented supply chains - especially in emerging markets - demand evolution beyond traditional port operations.

Action: Implemented near-shoring strategies, deployed centralised data infrastructure across 57 terminals (achieving 75% efficiency gains), and repositioned automation as workforce empowerment - highlighting women and differently abled workers in digital operations roles.

Narrative Shift: From “global ports operator” to “partner for resilient, inclusive, and sustainable trade.”

Outcome: Strengthened ESG credentials, achieved operational efficiency gains during high-volatility quarters, positioned as a Davos-level voice for trade reform.

“We’re not just moving trade. We’re moving towards a world where trade works for everyone - even in the face of disruption.”

— DP World Leadership, 2025 Strategic Outlook

What’s Driving the Disruption?

The logistics narrative revolution didn’t happen in a vacuum. It’s a response to five years of compounding shocks:

The Pandemic: COVID-19 exposed the brittleness of just-in-time supply chains, triggering a permanent shift toward resilience-first design.

Trump 2.0: The return of aggressive U.S. tariff policies under the renewed Trump administration has brought duties on pharmaceuticals, steel, autos, and consumer goods—with baseline rates jumping from 2% to over 20% in some categories.

Rule Fragmentation: The WTO’s multilateral framework is weakening. From 2020–2023, trade-distorting policies increased by 66%, while trade liberalization measures declined by 22%.

New Power Brokers: Non-aligned economies like the UAE, Vietnam, India, and Brazil are emerging as trade hubs, benefiting from “friendshoring” strategies as companies seek to minimize U.S.-China exposure.

Regional Blocs: RCEP, AfCFTA, and ASEAN partnerships are strengthening South-South trade linkages, reshaping the geometry of global commerce.

Readiness Checklist: ’Volatility-Proof’ Your Business

1. 🧭 Map Your Exposure - Don’t Fly Blind

Audit all trade flows for direct and indirect tariff exposure. Include Tier 2 and Tier 3 suppliers—hidden dependencies often cause the biggest disruptions.

2. 📦 Build a “China+1” Strategy

Diversify sourcing beyond any single hub. Vietnam, India, Mexico, and Eastern Europe are common alternatives, but even basic category redundancy strengthens resilience.

3. 🏗️ Design for Flexibility, Not Just Efficiency

Ultra-lean supply chains fail fast under stress. Invest in modular networks with regional fulfillment options, pre-cleared inventory pools, and multi-modal shipping.

4. 📉 Treat Tariffs Like a Financial KPI

Tariff rates now move faster than interest rates or materials costs. Monitor them with the same rigor.

5. 🛂 Leverage Customs Programs and FTAs

Enrol in trusted trader programs (CTPAT, AEO) and make use of free trade agreements (USMCA, RCEP) to reduce duties and expedite clearance.

6. 🧪 Invest in ‘Tariff Engineering’

Adapt product design or assembly locations to qualify under more favourable HS codes or country-of-origin rules - automakers did this in 2024 to avoid 25% Chinese vehicle tariffs.

7. 📜 Use Contractual Clauses to Share Risk

Update supplier and customer contracts with force majeure and tariff-sharing provisions. Static contracts are a liability in dynamic environments.

8. 🌍 Localise for Strategic Markets

If your market is stable but your trade route isn’t, consider partial on-shoring. Mexico and Canada serve as buffer zones for North American operations. Chinese manufacturer

9. 🧠 Establish a Trade Intelligence Capability

Create a dedicated team (or outsource) to monitor regulations, sanctions, and tariff changes. Trade intelligence is now a competitive advantage.

10. 🎯 Tell Your Trade Story - Internally and Externally

Clearly communicate supply chain changes to customers, partners, and investors. Transparency turns turbulence into a trust-building opportunity.

💡 Bonus: Influence the Rules

Join business coalitions lobbying for trade modernisation. Advocacy is a strategic mitigation tool.

The Bottom Line

The future of global trade isn’t frictionless - and without wanting to sound too dramatic - it might never be again.

But much like their peers in the often-fickle digital and technology services industry - for companies on the front line of trade that are able to evolve from executors to advocates, from carriers to consultants, volatility isn’t a threat to be outlasted. It can be a stage from which to become irreplaceable.

As customers increasingly ask not just “Can you ship this?” but “Can you explain what’s happening and help us navigate it?” - the companies that master both the logistics and the narrative will define the next era of global commerce.

In a fractured world, clarity is cargo. And the true storytellers are the ones setting the course.

We’re now live on Substack!

Like this article? For more content on the power of storytelling as wells insights and free tools for leaders to help you build the storytelling muscle visit Storied. my newsletter on Substack